Two categories of expenses in merchandising companies are – In the realm of merchandising companies, expenses play a pivotal role in shaping profitability and overall financial performance. Understanding the two primary categories of expenses—Cost of Goods Sold (COGS) and Operating Expenses—is crucial for effective management and decision-making. This article delves into the intricacies of these expense categories, providing a comprehensive overview of their components, impact, and strategies for optimization.

COGS, a direct expense, encompasses the costs associated with acquiring and preparing goods for sale, while Operating Expenses, an indirect expense, include the costs incurred in the day-to-day operations of the business. Both categories have distinct characteristics and implications, which will be explored in detail in the following sections.

Types of Expenses in Merchandising Companies: Two Categories Of Expenses In Merchandising Companies Are

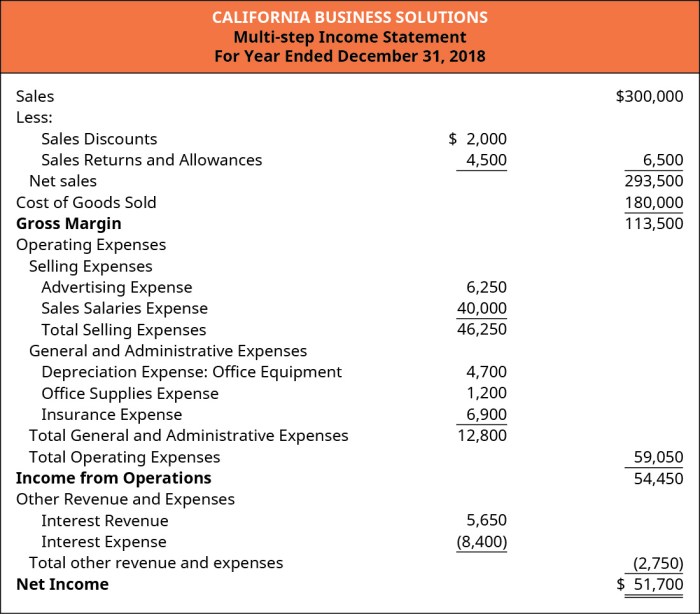

Merchandising companies incur two primary categories of expenses: cost of goods sold (COGS) and operating expenses. COGS represents the direct costs associated with acquiring and preparing goods for sale, while operating expenses encompass the indirect costs incurred in running the business.

Cost of Goods Sold (COGS)

- Components:COGS includes the purchase price of goods, freight-in, import duties, and any other direct costs related to acquiring and preparing goods for sale.

- Calculation Methods:COGS can be calculated using three methods: periodic inventory, perpetual inventory, and gross profit method.

- Importance:COGS is a crucial factor in determining the profitability of a merchandising company, as it directly impacts the gross profit margin.

Operating Expenses, Two categories of expenses in merchandising companies are

- Major Types:Operating expenses typically include rent, utilities, salaries, advertising, depreciation, and insurance.

- Factors Affecting Operating Expenses:The level of operating expenses can be influenced by factors such as business size, industry, location, and management efficiency.

- Control Strategies:Companies can implement various strategies to control operating expenses, such as negotiating lower costs with suppliers, optimizing staffing levels, and improving operational efficiency.

General Inquiries

What is the difference between COGS and Operating Expenses?

COGS directly relates to the costs of acquiring and preparing goods for sale, while Operating Expenses encompass the costs incurred in the day-to-day operations of the business, such as rent, salaries, and marketing.

How does COGS impact profitability?

COGS is a major determinant of gross profit, as it is subtracted from revenue to calculate this key metric. A higher COGS can reduce profitability, while a lower COGS can enhance it.

What are some strategies for controlling Operating Expenses?

Effective strategies for controlling Operating Expenses include optimizing inventory management, negotiating favorable terms with suppliers, and implementing cost-saving measures in areas such as energy consumption and employee benefits.